This post was written by Teddy Woodhouse, Web Foundation Research Analyst and Advocate. It was adapted from a longer article, originally published on poliTICs 29, in Portuguese. Follow @TeddyWoodhouse on Twitter.

Users across Latin America and the Caribbean who use 1GB of mobile internet each month have to buy more expensive plans with larger data allowances as compared to like-minded users in Africa or Asia. This pricing structure for data plans inflates the cost of connectivity across much of the Americas and impedes progress towards affordable internet access for all.

These insights come from the latest data from the Alliance for Affordable Internet (A4AI), which conducts a pricing snapshot twice a year across 99 low- and middle-income countries and makes the information publicly available. See the latest data.

The Alliance for Affordable Internet and several international organisations, including the UN Broadband Commission and the World Bank measure affordability based on the market cost of 1GB mobile data as a percentage of the average income. On average, the cheapest route to 1GB of mobile data per month in Latin America and the Caribbean requires a user to buy an additional 1.6GB beyond that minimum. In over half of the LAC countries in the A4AI study, users must buy at least 2GB as the cheapest option: this encourages users to buy more data, at higher price points, even when their use may not require such an expense. In many countries, there simply is no plan that lets an individual use 1GB over one month: they must either buy 1GB and use it in a shorter period of time (e.g. one week) or buy more data than they need.

The affordability gap among middle-income countries narrows when we try to compare mobile internet prices on a per-GB rate across countries. This theoretical ‘per-GB’ rate takes the most affordable mobile data plan in each country and calculates how much the user is paying for each GB. When doing so, the average affordability of 1GB across middle-income countries drops from 2.4% of the average monthly income to 1.6%. With a regional comparison, data costs drop the most in Latin America and the Caribbean: 43% from their market reality.

Fig. 1. Comparison of price variance in middle-income countries between consumer cost of 1GB mobile broadband and a prorated affordability.

| Average consumer affordability, 1GB | Average prorated affordability, 1GB | Average Difference | |

| Africa | 2.75% | 2.04% | 26.4% |

| Latin America & Caribbean | 2.96% | 1.75% | 42.8% |

| Asia | 1.51% | 1.01% | 29.7% |

| Middle-income countries (average) | 2.36% | 1.58% | 32.6% |

Source: Author’s calculations based on data from the Alliance for Affordable Internet (2019).

Per gigabyte, users in middle-income Latin American countries pay less than users in middle-income countries in Africa as a fraction of their income. However, when buying actual data plans, Latin Americans face hidden price inflation to be able to reach the international benchmark for affordable data. This trend connects with lower average market competition in the region as well.

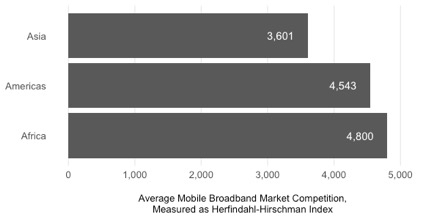

Fig. 2. Region comparison of mobile broadband market competition

Source: Author’s calculations based on data from GSMA Intelligence (2019)

When we looked at a number of factors that could influence the price of mobile data, average incomes and market competition were the two that appear to have the greatest potential influence on the price of one gigabyte. Between the two variables, market competition held an even closer relationship with the cost of 1GB of mobile broadband: this suggests that market competition is more influential than even the average income in determining what kind of price operators will set as the cost to come online.

As mobile broadband markets become less competitive and more concentrated, the price that a consumer will have to pay to get at least 1GB of mobile broadband will typically rise. So, for policymakers and regulators looking to make internet access more affordable, focusing on encouraging market competition is a clear and effective strategy to drive down mobile data prices.

Data plans structure the mobile broadband market, and the availability of certain plans to users carries consequences on measures of affordability and access to the internet. With the latest pricing data from A4AI, we see early evidence of a relationship that connects higher internet costs across Latin America and the Caribbean, data bundles that push users to purchase more than they may need, and lower rates of market competition. As a priority, regulators should ensure that effective levels of market competition encourage both investment from operators in network developments as well as pricing competition that passes savings down to consumers. If not, regulators run a real risk of missing out on the potential dividends of greater affordability and wider access to the internet for millions.

For updates about our work, sign up to our newsletter and follow us on Twitter at @webfoundation.

To receive a weekly news brief on the most important stories in tech, subscribe to The Web This Week.